FAQs

Frequently Asked Questions

There’s no fee if Stryde is unable to find your client’s business any savings across the specialized tax incentives and vendor audits we conduct for them. In the rare worst case scenario where no savings are found, they receive reassurance that their business is operating at optimal lean efficiency with no fiscal waste – and it costs them, and you, nothing. “No Savings, No Fee.”

Why not just refer clients to another accounting firm that offers these specialized tax services?

While some larger accounting firms do provide some of these services, none are as comprehensive – we provide not just tax saving services, but select vendor audits as well – nor are they provided on a contingent fee basis. They’re also not likely to defend their work in the unlikely event of an audit at no additional cost. This means your clients could end up paying more in these additional accounting fees than you save them for their business, which isn’t likely to help with client retention.

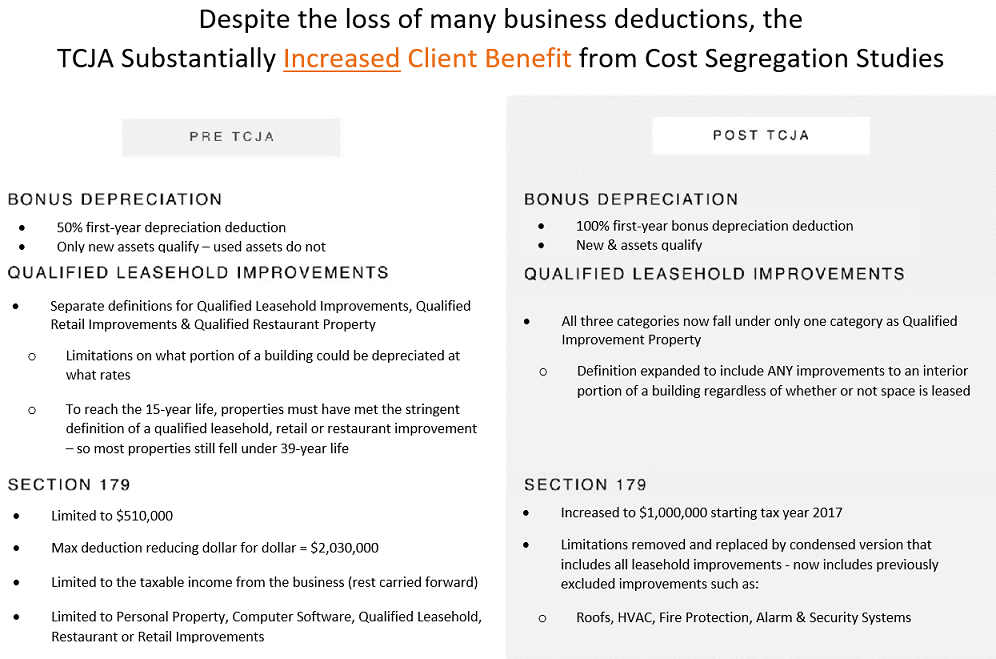

Did the TCJA reduce the benefit from these tax incentives as it did for most other business tax deductions?

Just the opposite. Cost segregation, R&D and WOTC tax credits were all strengthened under TCJA. This table shows the favorable impacts of TCJA on cost segregation studies.

It’s possible, but highly unlikely that when they’re presented with six or seven figure savings opportunities they’ll be looking to blame someone. They know most accountants are generalists and simply lack the specialized expertise – structural engineering, intellectual property law, etc. – required by the IRS to successfully claim these tax savings.

Our work provides the necessary documentation for their accountant to file with the IRS or other taxing authority – and they’re also not likely to object to your additional billable hours required to file the claims for the savings our studies carefully document.

In its 18+ years of performing these specialized tax incentive services, our company has never had a single denial of savings it has documented for its clients. Our proprietary software incorporates industry best practices that optimize tax credits, refunds and deductions while conforming with relevant constraints by subjecting them to our rigorous internal audit review, which is why we provide audit defense support at no additional cost if there were ever an audit of our work.

This is also why we’ve been chosen as a national preferred provider by Keller Williams Commercial, the NFL Retired Players Association, many trade associations and accounting and financial services firms as their specialized tax services partner.

Most clients benefit from multiple savings opportunities, with hiring incentives like the Work Opportunity Tax Credit (WOTC) and credit card merchant fees and workers comp audits applicable to most businesses. Our typical client averages $240,000 in combined savings from three or more service categories, for over $4 billion in aggregate client savings to date.

WOTC Example: When you click here and enter a client’s industry and annual hiring experience, you’ll receive an initial estimate of their probable tax credit savings given our past experience with WOTC and other hiring incentives for their industry and, in certain industries, potential R&D tax credits for current employees as well. From there, we’re able to analyze their business for other potential savings opportunities they can pursue in whatever order they prefer.

Do I need to recruit new talent to provide these services for my clients?

Absolutely not. You’re able instead to rely on Stryde’s proven expertise to analyze relevant savings opportunities for your current and future clients and to provide back office implementation support as needed (for example, for WOTC and hundreds of other federal and state hiring incentives with myriad filing requirements).

Is there a conflict of interest if I receive commissions on Stryde’s work for my clients?

There’s no conflict of interest in generating savings that bolster your clients’ bottom lines. Helping clients improve their business performance and profitability is the core of accountants’ fiduciary duty to their clients and certainly isn’t putting your interests before theirs.

Indeed, it’s all about pursuing and protecting their interests even more proactively. And if they fail to receive any benefit, it costs them nothing and neither you nor Stryde receives any financial benefit in that unlikely event.

Of course, you’re always free to discount your billable hours for the additional work required by your firm to claim the savings that Stryde finds for them if that makes sense for you and will further ingratiate you with clients. They’re highly likely, however, to be very grateful that you’ve found these cash flow benefits for their business without needing to further enhance that benefit.

How does Stryde’s screening tool for client savings work?

Watch this brief demo video to see it in action…